Leaving the Hill Part II: Landing on Your Feet

Part 2 in series on leaving Congress, written with Melissa Dargan

Ready for takeoff!

You’ve decided—for whatever reasons, and in whatever circumstances — that it is time to move on from Congress. You have a pretty good idea of where you’re going next, but when you actually picture yourself walking out the door, it gets a little hazy.

This article addresses the nuts and bolts of how to leave smart, what to expect when you do, and four steps in your transition:

Understanding your needs

Making a plan to leave, including understanding your separation guide, and factors that might affect your timeline

Your 2-4 week exit checklist (including options if you’ve been laid off)

Managing your Thrift Savings Plan (TSP) account after leaving

It is best used as a toolkit after you’ve decided to leave and know roughly where you are headed next, but while you still have some control over the details. It also contains tips and advice that will apply no matter where you are in your transition, much drawn from what worked well for others or that they wish they had known earlier or done differently. Got a tip or see something we missed? Reach out at info@popvox.org.

Your well-being matters.

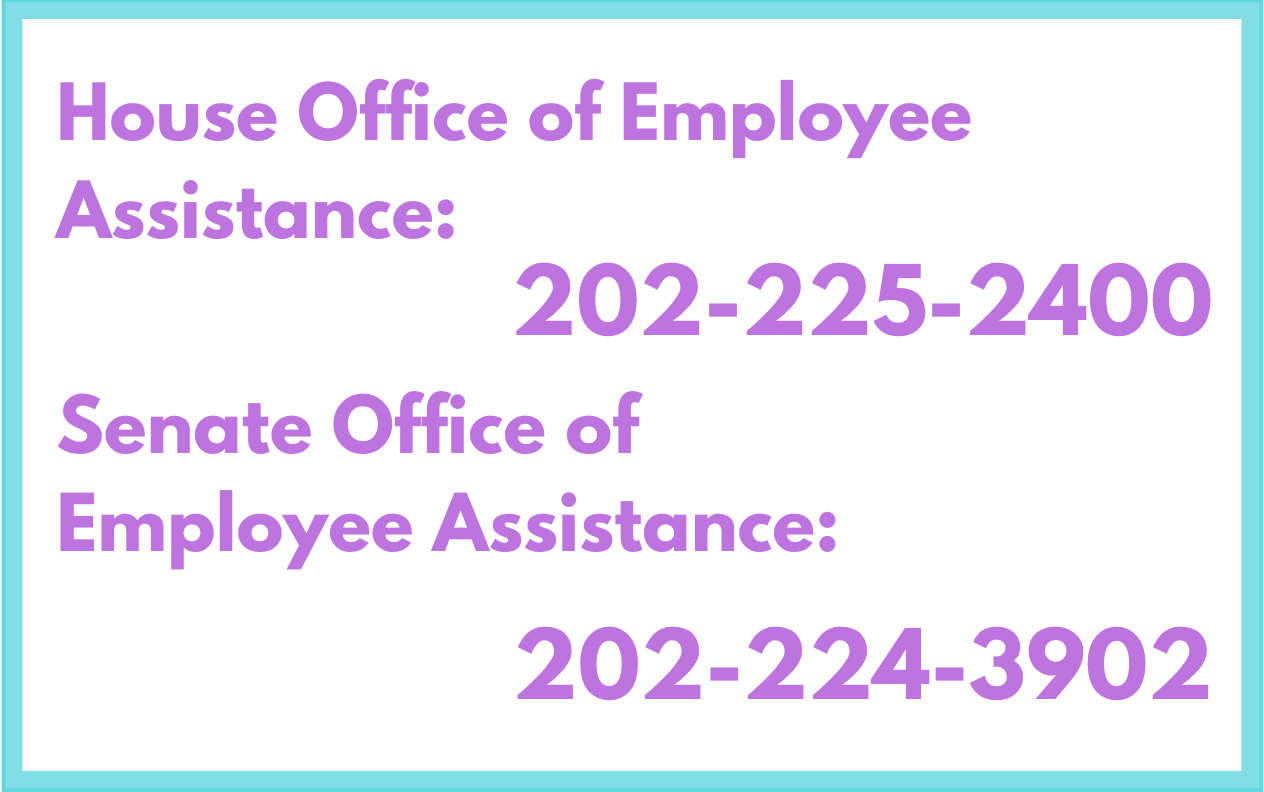

As you plan for your career future and financial stability, don’t neglect your own mental health and well-being. Leaving Congress can be an intensely emotional process no matter how or why you have decided to take a new path. You may feel anxiety, doubt, uncertainty, and difficulty adjusting to a different pace. That’s all okay and normal (especially considering the extra challenges of the past few years). Transitions can be difficult. You are not alone!

Try to give yourself a break to recharge your batteries. Consider seeking support in whatever capacity makes most sense for you, whether virtual or in-person therapy, support groups, self-help resources, or mindfulness. Reconnect with your priorities, hobbies, family and community support structure, and anything else you need to build up or rebuild your foundation so you can enter the next chapter energized and ready to go. The Office of Employee Assistance provides support services for employees transitioning out of Congress and our friends at Capitol Strong list resources available to current and former congressional employees.

Four Steps in your Transition

UNDERSTANDING YOUR NEEDS

Make a monthly budget

If you haven’t made a budget before, taking some time to get familiar with your average monthly spending on different categories of expenses might be helpful: some standard ones to include are rent/mortgage payments, any debt payments (like credit cards or student loans), child care, other family obligations, groceries, transportation (gas or public transportation fees), insurance (health, car, apartment, life), medical expenses, utilities (including your phone bill), restaurants, entertainment, clothing, and miscellaneous expenses. There are also a number of great budget apps that calculate these automatically for you, and can even help you make a plan to save money if that fits into your lifestyle and goals.

Check your savings and plan for the future

Before leaving your job, check your savings (especially if you are leaving without another job lined up). As the pandemic has shown us, three months of savings may not be enough to provide enough time to get back on your feet after a big transition or an emergency: a good goal is to build a 6-9 month emergency savings fund just in case. This amount should cover 6-9 months of your necessary expenses (probably much less than the total you would spend in a normal month)

Try making a few potential budget options for your current level of spending, a slightly reduced level of spending, or a dramatically reduced level of spending to see how far your savings will get you under different scenarios. Don’t forget to build in a cushion for unforeseen expenses (like a medical emergency or car repairs) and account for potential expenses involved in a life transition, like a security deposit for a new apartment or moving expenses as well.

Don’t forget moving expenses

The feeling of a fresh start in new surroundings can be a great way to jump-start your next chapter. To move smart, make sure to budget and plan for some of the additional costs of a move:

Account for moving costs: If you’re moving to a new city for a W-2 job, then your employer might have offered to chip in for your moving costs. If so, congratulations! Make sure you find out what kind of moving service they’re willing to pay for (e.g. the spectrum between a shipping container and white-glove full-pack service), and what’s going to be expected of you in terms of packing and timeline.

If you’re moving on your own, start by taking into account your distance, existing vehicles, and team. For a short move, less than a full apartment, and if you have friends and family you can bribe to help, you might be able to save money and be flexible on timing by DIYing with a rented truck or van. If you’re on your own, short on vehicles, or making a really long-distance move, then you may want to consider a moving company. There are a variety of options for more or less-involved service, but regardless make sure to get several quotes (and a referral if possible—sometimes you and the referrer will both get a discount), and check if the quotes you’re given include all taxes, tolls, permits, and other fees.

Keep in mind that depending on the circumstances of your move, it might pay to mix and match—for example, pay for movers for your heavy furniture, and move the lighter, smaller items yourself in a rental truck or your own car.

Check your budget: You planned your budget above, but make sure that it’s based on the cost of living for your new planned location. Check on rental listings to get a sense for if you’ll be asked for your first/last month in addition to your security deposit (usually another month’s rent) and any parking or pet fees when you’re budgeting—while not every apartment will ask you for all three, better to be surprised with extra savings to spend on furniture than caught short on your dream place.

2. DEPARTURE PLAN AND TIMELINE

Consult Official Separation Guides

The House Employee Separation Guide provides information on the duties of a departing employee and what to expect.

Plan your Timeline to Maximize Benefits

Some Congressional benefits can only be kept if you work for Congress for a certain period of time. Getting familiar with and planning around these vesting milestones can help you keep benefits you’ve earned.

Retirement and Savings

The Federal Employees Retirement System (FERS) is the retirement plan for all U.S. civilian employees that includes a Basic Benefit Plan (in Congress, that’s the Congressional Pension), Social Security and the Thrift Savings Plan (TSP).

Thrift Savings Plan (TSP)

As an employee of the U.S. Congress, you are a a FERS employee. If you enrolled in the Thrift Savings Plan (TSP), you have been saving money every month from your own paycheck plus a “match” from your employer. The contributions you made are automatically “vested.” They belong to you. But there is a minimum service requirement for you to be able to keep the matching contributions. For FERS employees who are Members of Congress or congressional employees, the TSP vesting requirement is 2 years. That means if you are close to a two-year tenure in your congressional career, making the decision to stay on for a bit longer to reach the two-year milestone can have major financial benefit in the future.

Congressional Pension

Members and Congressional staff who worked on Capitol Hill for at least five years of service are vested in the pension system, which you can begin to collect at:

- 62 years of age after five years of service

- 50 years or older after 20 years of service

- Any age after 25 years of service

The monthly pension amount is determined by a formula that takes into account the number of years of service and average top 3 salaries. So, for example, if you were a staffer for 20 years with a $160,000 average of top three salaries, your annual pension would be $54,400/ year in retirement (017 X $160,000 X 20).

Health Insurance

Health insurance is one of the most important employer-provided benefits and one you want to plan for in your transition. You will be able to stay on your congressional plan until the end of your separation month. That means that timing your departure date early in the month will give you a little more time and flexibility to get your health insurance settled. After that, your options include:

Moving to another employer-provided plan

If you are headed immediately into a new job that offers health care, the transition will just require some paperwork. As you select a new plan from your new employer’s offerings, be sure to double check the co-pay and deductible rates and to ensure that you can stay with your primary care physician or other doctors with whom you have a relationship.Paying for COBRA to continue your congressional coverage

If you have very particular health needs that require you to continue on the same plan (maybe starting a new job with benefits in a few months), you may want to consider COBRA, which allows you to remain with your congressional insurance for up to 18 months if you pay for the full cost of the coverage (no employer match). COBRA can be very expensive, so make sure to check the cost before deciding.Purchasing a plan on a state health exchange

You will qualify for a Special Enrollment Period on a state health exchange for 60 days after losing employer-provided health coverage. This allows you to find a new health plan without having to wait for the once-per-year “open enrollment” period.

If you’ll be switching to a marketplace plan, for a great starting point, see this guide to health benefits for federal employees. While this covers federal benefits, it also includes a guide to plan types, common terms, comparing plans, and more.

Health Insurance Tips

Coverage: Start by looking over your health care usage over the last 3-5 years. What have you used monthly, quarterly, annually, or sporadically? You may not have needed coverage beyond a few trips to Urgent Care, or you may be managing chronic conditions like diabetes, high blood pressure, or ongoing mental health treatment. If there are specific providers you must continue to see, choosing a plan that covers them will be important.

Cost: Your health insurance costs are going to have three major dimensions: 1) your premiums, 2) your copays, and 3) your deductible. Use your annual coverage needs from above as the starting point to determine if you want to pick a plan with a lower deductible and higher monthly premiums or a higher deductible and lower monthly premiums.

Location: Part of staying on top of regular preventive care, as well as making sure you’re set in an emergency, is making sure that your care is accessible. If you know where you’ll be living, try to pick a plan that will cover a nearby Primary Care Physician (PCP) and an Urgent Care facility. If you’re not sure where you’ll be living, try to pick a plan with a wide network so you’re not limited on options later in the year.

Plan type: Different types of available plans like Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs) have different pros and cons. For a handy reference, see this guide to federal employment coverage (chart on page 15).

Remember: while you’re on the Exchange, you can change your coverage yearly in open enrollment season; the plan that’s right for you if you’re on a tight budget and have no pressing health needs may not be right for you in a few years when you’re more established. Also, new plans are added every year, so it’s worth browsing!

Student Loan Repayment Program

All congressional offices may add requirements if you are in the Congressional student loan repayment program. Before you leave, check to see if there are any requirements (ex: must stay 2 years with Member office). Most offices do not place these restrictions, but you want to double check to ensure you are not required to repay the loan.

Unemployment Benefits

If you were terminated from your job through no fault of your own (NOT if you quit your job voluntarily or were fired for cause), you may be eligible for unemployment insurance (UI). States have very different requirements and rules around eligibility and details of coverage. The House of Representatives has a form you can take to file a claim for UI with your local office. You will also need your Social Security card, most recent earnings statement (available on HouseNet for House employees), and your W-2 (available from the Office of Payroll and Benefits).

File as soon as possible after you are separated from your job to make sure you don’t miss out on any available benefits, and to avoid processing delays.

3. EXIT CHECKLIST

It’s finally here! You’ve given your notice, and you’re on your way out. Avoid the crunch on your way out the door by making a plan to handle the following:

Change of address

Withdrawing or changing memberships

Submitting expense reimbursement or financial disclosure paperwork

Signing out and closing accounts on office software

Warm handoffs and introductions to new staff if applicable for constituent casework, committee staff or contacts in outside organizations

Exit memo or exit interview and make sure to get that photo with the Member or behind the dais

Create the infamous Hill auto-reply and don’t forget to add your personal email if you want people to stay in touch

4. TAKE CARE OF YOUR TSP

If your TSP account balance is $200 or more, you can keep the money in the TSP when you leave the federal government. It is important to note that after you separate from your federal government job, you CANNOT to make additional employee contributions into the TSP. You CAN (1) change your investments, (2) transfer eligible money into your account, and (3) enjoy the low management costs. Remember, even though you can’t add more contributions, your TSP account will continue to accrue earnings or losses based on your investment choices.

Your post-Hill plans may be affected by what your long-term plans. For instance, are you leaving the federal government for good? Or can you see yourself returning back into the federal government (Administration, Congress, Agency etc)?? This can affect the choices you make in the short-term.

For example, let's say you plan to work on a Congressional campaign for 9 months (until election day). After the campaign, you hope to join that newly elected Member of Congress. If you plan to return to government, you may want to leave your TSP retirement plan where it is rather than moving it or withdrawing it upon separation because you’ll probably need to transfer the money back in upon returning to working in Congress.

Regardless of your plans, if you are leaving the federal government, here are the three things you MUST DO first:

Make sure the TSP has your current address

If you have any TSP loans, pay them off within 90 days of leaving

Decide what you want to do with the money in the TSP (see 5 options below)

Each individual is different and there is no ‘one size fits all’ choice. Different options may work better for you. Be sure to consult a financial advisor to ensure you are making the right financial choice.

TSP Options:

Option 1:

Leave Assets in your TSP Account

This option is as simple as it sounds. The easiest thing to do is leave your assets in your TSP account. However, you need to keep in mind that you will not be able to make additional deposits to your account once you are no longer working for the government. You will however still be able to choose investment options - ie: which funds you want the money to be in. Basically, the funds will sit there and grow.

ADVANTAGES:

Easy to use: The TSP is already easy to use, and this is the easiest option.

Low Expense Ratio (low fees): the fees are among the lowest you can possibly find – even lower than most popular index funds.

Can move later: No timeline. You always maintain the option of moving your funds from the TSP at a later date.

DISADVANTAGES:

The TSP has limited investment options. There are only 5 main funds to choose from and lifecycle target funds.

You will also not be able to make new contributions or take loans from your old TSP account.

Having one more account to keep track of can also be a headache for some people. Not only does it involve more work when balancing your assets, but you also must maintain more paperwork.

Option 2:

Transfer your TSP account assets into an IRA

An IRA is an Individual Retirement Account. IRAs are tax-advantaged accounts that individuals use to save and invest for retirement. Basically this means you are moving your money from the TSP into a qualified retirement account controlled by you

ADVANTAGES:

AVOID Taxes & Penalties: The biggest advantages of rolling over your TSP into an IRA are avoiding the 10% early withdrawal penalty, maintaining certain tax advantages,

CONTROL: controlling your investment options which will no longer be limited to the investment options in the Thrift Savings Plan or your new employer’s 401(k) plan.

Not just the G, C, S, I and F funds or life-cycle funds, depending on the IRA account you open up and with banking institution, you can invest in a wide range of choices - stocks to mutual funds to ETFs and the list goes on.

LIMIT EXPENSES: Total control allows you to limit your expenses and maintain full control of your investment.

NOT FINAL: Rolling your TSP assets into an IRA does not mean it is final – you may be able to roll it into your new 401(k) plan later.

DISADVANTAGES:

You can't borrow against an IRA as you can with the TSP, which you would have been able to do if you rolled it into your new employer’s 401(k) plan

Depending on the IRA provider you choose, you may pay annual fees or other fees for maintaining your IRA, or you may face higher investing fees, pricing, and expenses than you would with a TSP.

Some investments that are offered in the TSP plan may not be offered in an IRA.

Your IRA assets are generally protected from creditors only in the case of bankruptcy.

Option 3:

Transfer your TSP account into your new employer’s 401(k) plan

This is when you move your TSP account to your new employer’s retirement plan. It is important to note transfers do need to go into qualified new accounts. So a traditional TSP can rollover into a traditional qualified 401K. A ROTH TSP should rollover into a qualified ROTH 401k plan. Make sure you do your research to ensure the transfer qualifies for tax purposes

ADVANTAGES:

Your retirement assets maintain their tax advantages and as long as it goes into a qualified retirement account, there should be no penalties or fees to transfer your money.

you will minimize the number of retirement accounts you have.

In certain circumstances you can borrow against your 401(k) if you want (I don’t suggest that, but depends on how much you need the money immediately).

DISADVANTAGES:

You are limited to your new plan’s investment options.

This is important if your new 401(k) plan has limited investment options or higher than average expense ratios, which cause lower returns.

Some employers have a minimum waiting period before you can sign up for their 401(k) plan, so you may have to wait before you can rollover your TSP assets.

Option 4:

Withdraw your TSP account assets in a lump sum

This means you withdraw your TSP retirement funds and take it out. Withdrawing your Thrift Savings Plan money in a lump sum is not usually recommended because you may be assessed with taxes (usually 20%) and early withdrawal penalties (10%). Together, these can eat up nearly a third of your total TSP assets.

ADVANTAGES

Your assets (minus income taxes and early withdrawal penalties) will be available for immediate use. This can help during periods of unemployment after separating from government service.

DISADVANTAGES

Taxes & Penalty: The huge tax payment and the 10% early withdrawal penalty (if you are under age 59½) reduces the amount you receive by almost a third.

Lose tax deferral: In addition you also all lose tax deferral benefits, potential future earnings, and lock in any market losses. Most importantly, you reduce the amount of money you have for your retirement.

Option 5:

Transfer your TSP account assets to a qualified annuity

This is an option few people are aware of, and one not many people use. Retirement annuities promise lifetime guaranteed monthly or annual income for a retiree until their death. These annuities are often funded years in advance, either in a lump sum or through a series of regular payments, and they may return fixed or variable cash flows later on. The basic idea behind these annuities it’s a guaranteed stream of income (payments), often for a lifetime.

ADVANTAGES

If you find a qualified annuity option, you will not pay early withdrawal penalties.

Create income stream for life

DISADVANTAGES:

Rolling your TSP into an annuity is final. Once it has been done, it cannot be reversed.

Many annuities come with much higher fees than 401(k) plans and IRAs, and many states charge high tax premiums on annuity plans.

In addition, you may pass away before your annuity pays out the amount of money you would have had in your 401(k) or IRA, leaving nothing for your heirs.

It will be paid out to you slowly, what if you need more earlier, can’t touch. NOT FLEXIBLE

Other Resources

Congre$$: tips and advice for personal finance and building wealth while working for Congress from Melissa Dargan

Partnership for Public Service: Go Government

Congressional Management Foundation’s collaboration with the Becoming Superhuman lab, with a short burnout assessment and other tips

CapitolStrong’s list of resources for staff in the wake of Jan 6th

Business Insider on staff pay

Keep in touch with the Capitol community with a membership in the US Capitol Historical Society